Wonderful Info About How To Avoid Paying Estimated Taxes

You can avoid federal penalties by paying, over the course of the year, the lesser of 90% of your 2022 taxes or 100% of your 2021 bill if your adjusted gross income is $150,000 or.

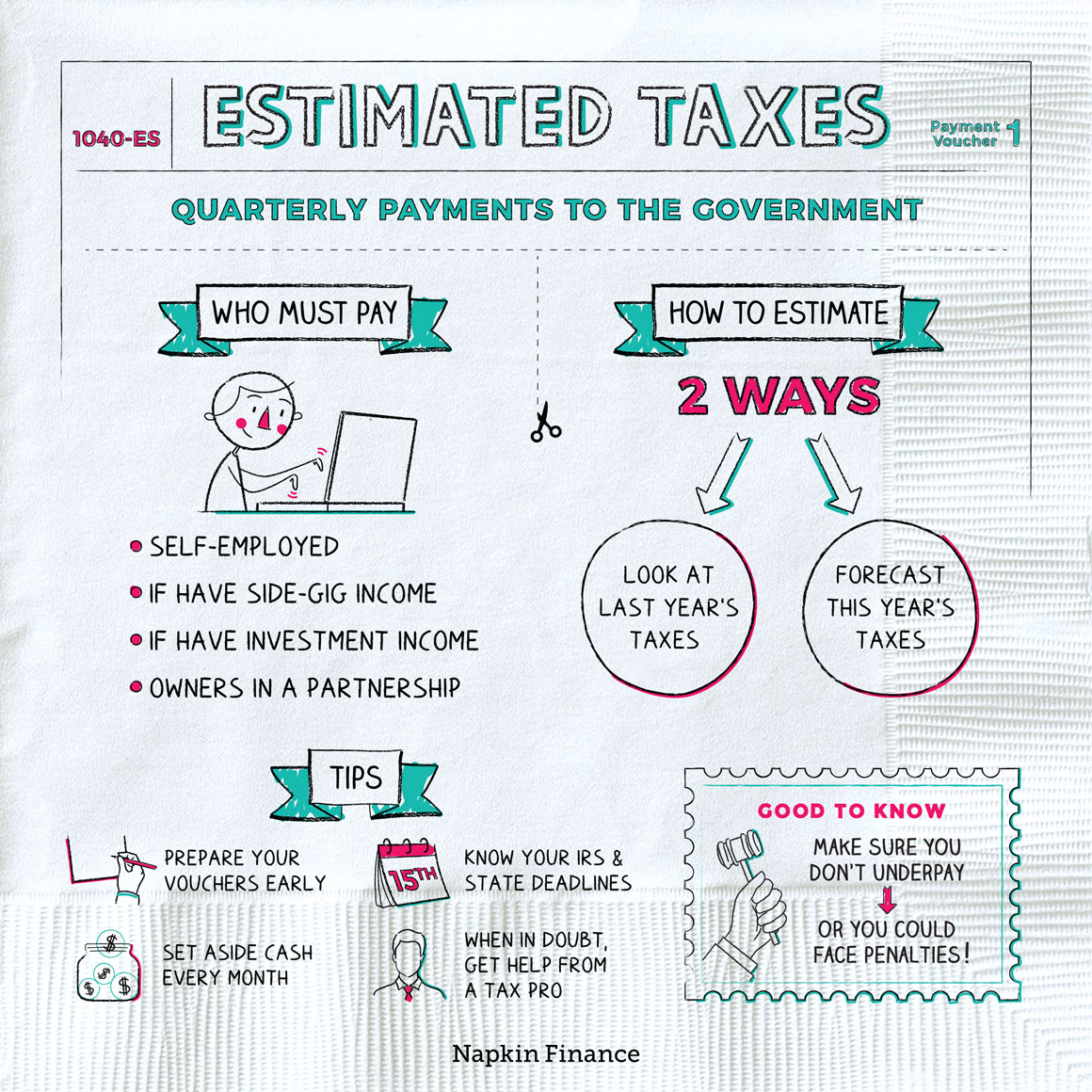

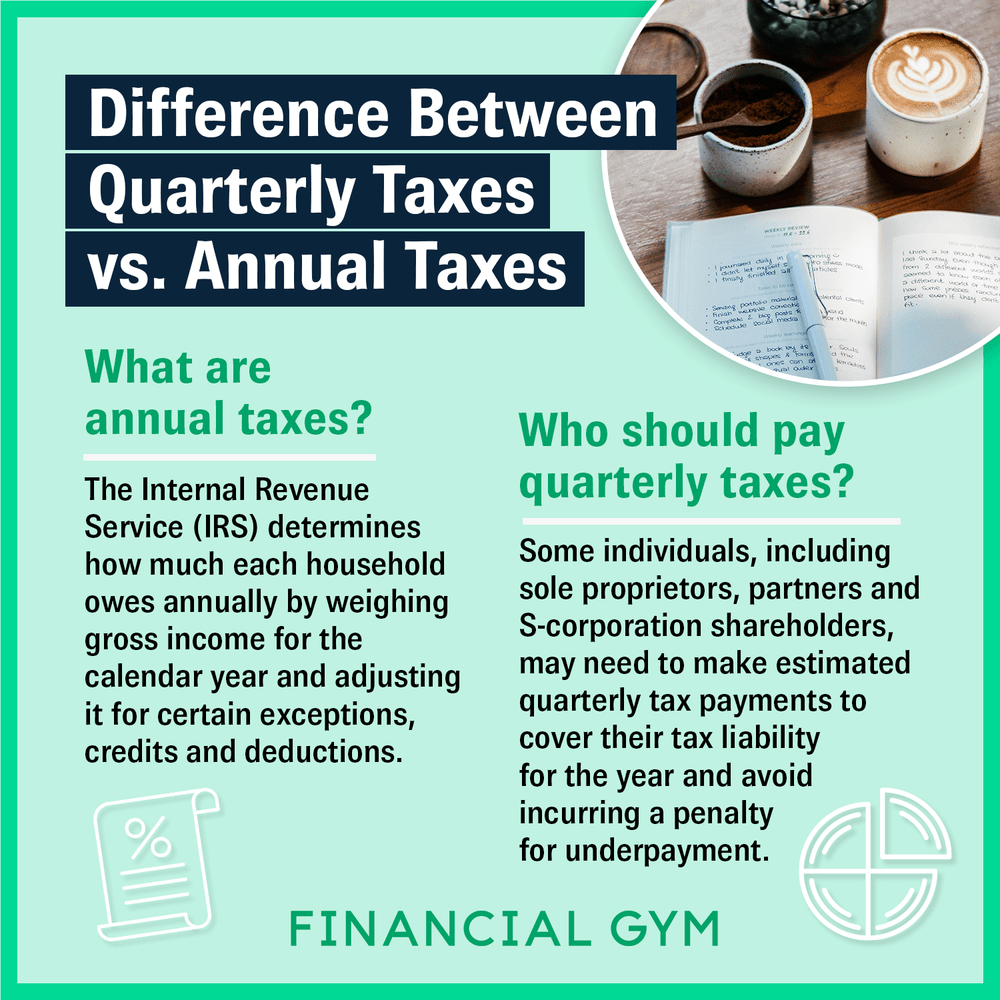

How to avoid paying estimated taxes. Individuals who are required to pay estimated taxes must make evenly distributed payments throughout the year. To avoid an underpayment penalty, you need to make sure that the total amount of estimated taxes you pay during the year equals at least 90 percent of what you owe in taxes. If you receive salaries and wages, you can avoid having to pay estimated tax by asking your employer to withhold more tax from your earnings.

However, in situations where a taxpayer’s income is distributed unevenly,. 10 tips on how to avoid paying taxes. Or (2) pay 100% of last year’s actual tax liability (or if you file jointly and your agi was at least $150,000.

Based on the tax brackets for 2022 for a single person, we can calculate your estimated income tax like this: This will help you avoid a surprise tax bill when you file your return. If you didn't pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated.

You can avoid making estimated payments by asking your employer to withhold more tax from your wages. 10% on your income up to. Making quarterly estimated tax payments during the year.

(1) always pay at least 90% of your current year estimated tax liability; Your filed tax return shows you owe less than $1,000 or you paid at least 90% of the tax shown on. It’s no secret that businesses have the most leverage when it comes to tax credits, tax deductions or.

Up to 25% cash back tips for avoiding underpaying estimated taxes if your income is less than $150,000, make sure that your estimated tax payments, along with any tax withholding. To avoid or minimize estimated tax penalties, adjust your tax withholding from your paycheck or estimate your tax bill and make estimated quarterly payments. To determine the right amount to.

Taxpayers must generally pay at least 90 percent of their taxes throughout the year through withholding, estimated tax payments or a combination of the two. You may avoid the underpayment of estimated tax by individuals penalty if: