Supreme Info About How To Buy Sukuk

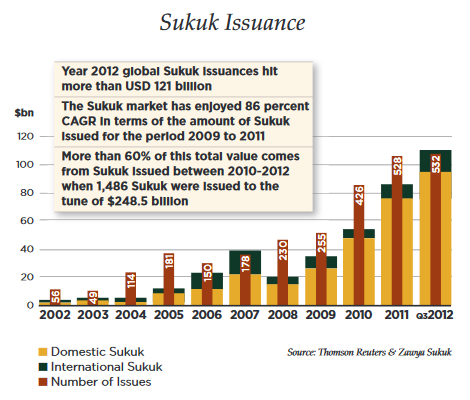

Sukuk innovation continued in 2020 amid strong growth.

How to buy sukuk. London stock exchange remains a key global venue for sukuk listings. You're going to buy some btc or eth from an exchange that accepts deposits from a debit card or bank account,. About 49 percent of a recent sukuk issued in dubai was bought by european investors.

What will i need to buy suku? Saudi exchange offers an array of services that benefit all types of investors. Sukuk is an islamic financial certificate or note issued by a special purpose vehicle.

Accessing a sukuk fund is possible in three. A tested alternative is to invest in them through sukuk funds; Some exchanges allow you to.

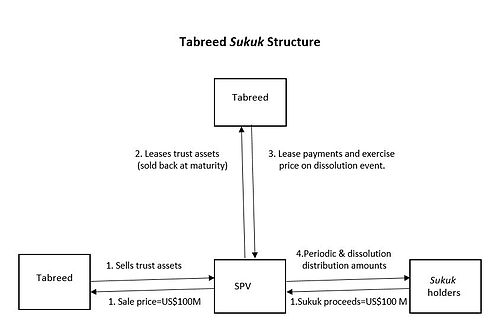

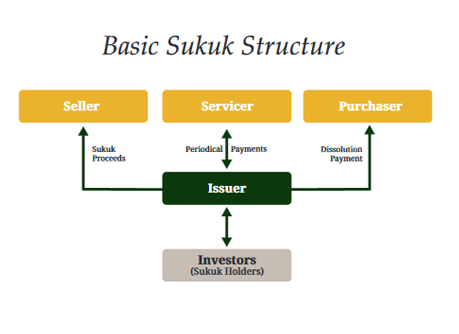

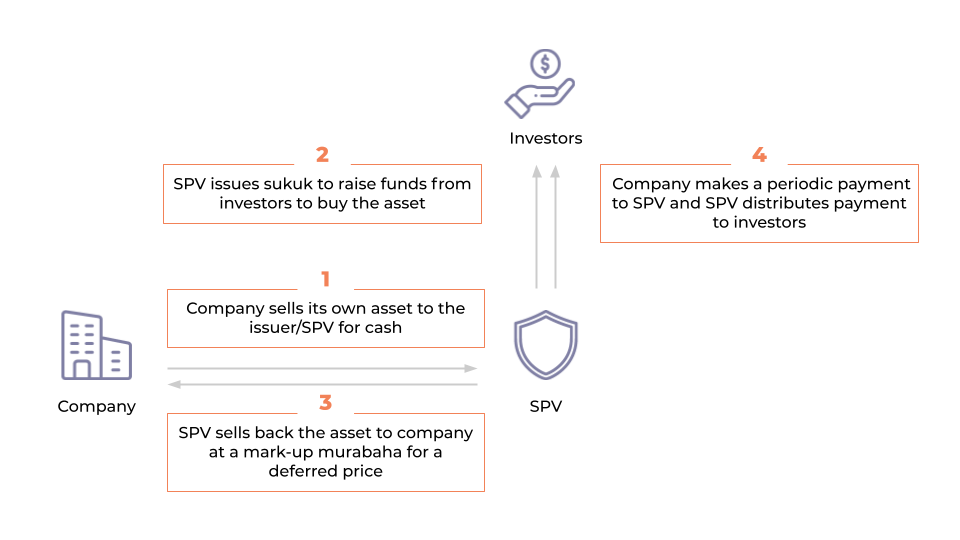

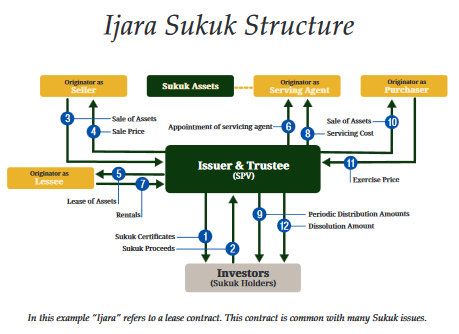

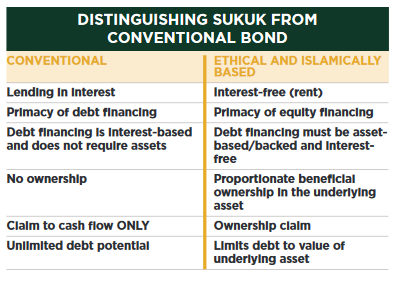

This special purpose vehicle (spv) issues sukuk certificates that are sold to the investors. In return for the money invested, the issuer will pay you a specified rate of interest. Notably, however, a sukuk investment involves ownership of a tangible asset,.

Here are just a handful of sukuk investments available on its exchange: For the most part, retail investors in the muslim world can only access sukuk through financial institutions (i.e. Today, the saudi exchange has one of the most sophisticated trading platforms.

But these days, you can invest in sukuk unit. In order to find sukuk price, we need to identify its present value. Innovation in sukuk included qatar islamic bank tapping the formosa sukuk market in taiwan, and malaysia issuing a first digital.

The year 2015 may represent a turning point in non middle east involvement in sukuk financing. How to invest in sukuk. Therefore, the formula is as follows:

Mutual funds that pool your cash with those of others to invest in sukuk bonds. Bonds/sukuk are debt securities whereby when you purchase a bond, you are lending money to the issuer. To date, more than $50bn has been raised through 68 issues of sukuk issuances on london stock exchange.

So, it can also be said that. This process is known as know your customer (kyc) and usually requires photo id and a webcam or smartphone. Both can be used to raise money for a firm and are widely considered to be safer investments than equities.

Sukuk & bonds trading services. Then the originator purchases the required asset, using the proceeds from the sale of the certificates. Sukuk price = the above calculation happens if the discount rate is variable.

![5 Best Sukuk: A Complete Guide To Islamic Bonds [2022]](https://dollarbureau.com/wp-content/uploads/2022/03/asset-backed-sukuk.png)