Divine Tips About How To Find Out If You Have A Bad Credit Rating

There are also a number of free credit score services you can use to check at least one of your scores from the most widely used credit bureaus:

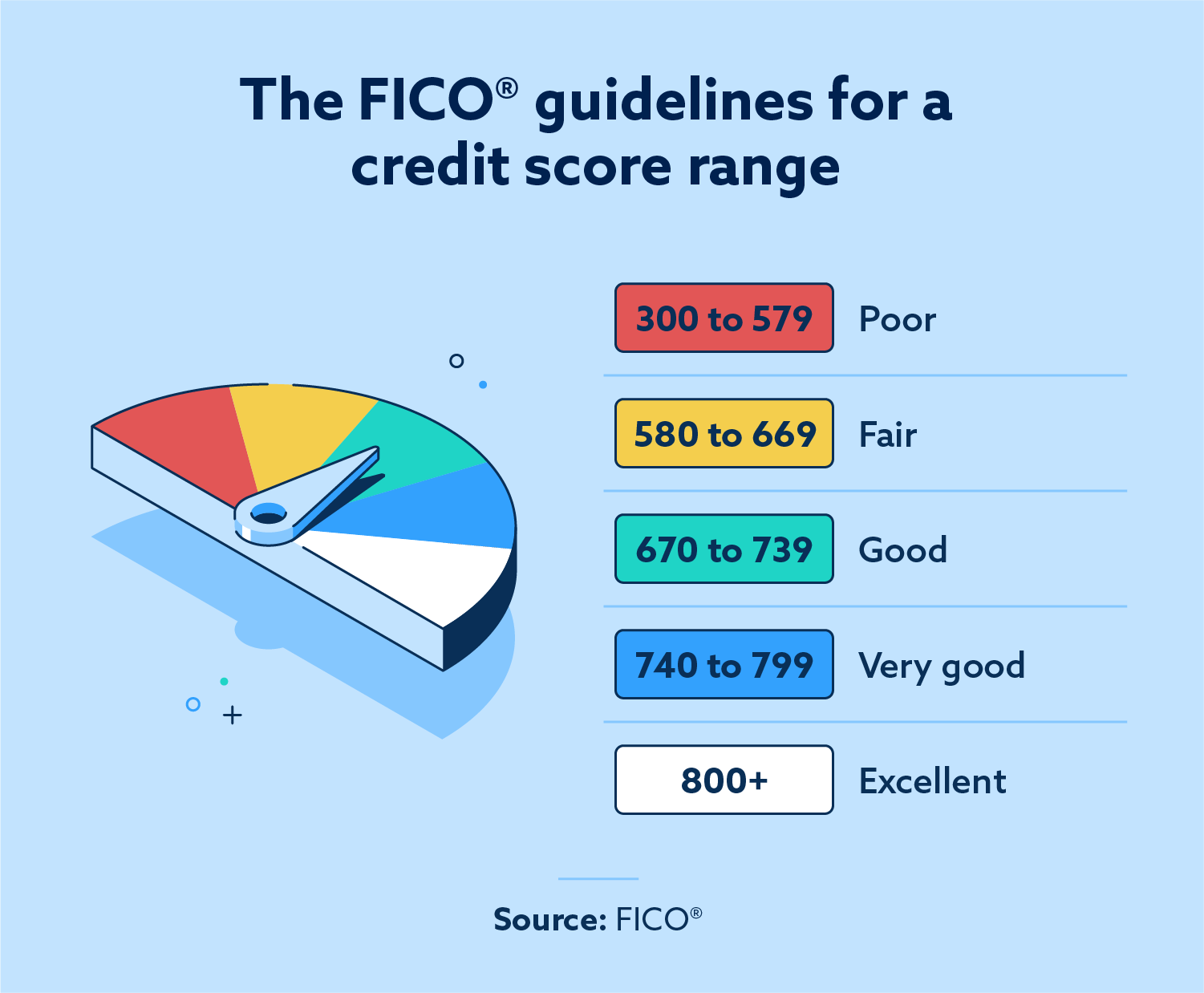

How to find out if you have a bad credit rating. Checking your own report will not hurt your credit. It can enhance your credit rating if you take for a loan for bad credit and make all of your payments on time and in full. A good score is 700+ and anything around 800 is excellent.

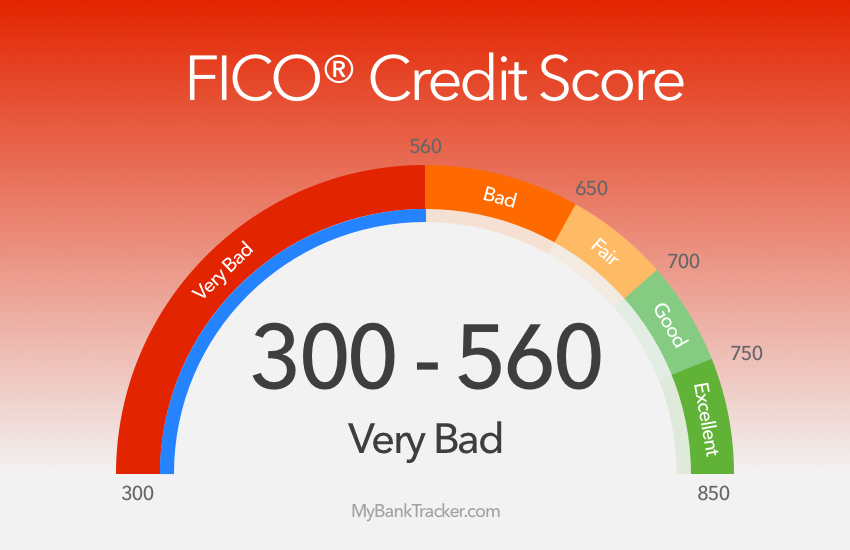

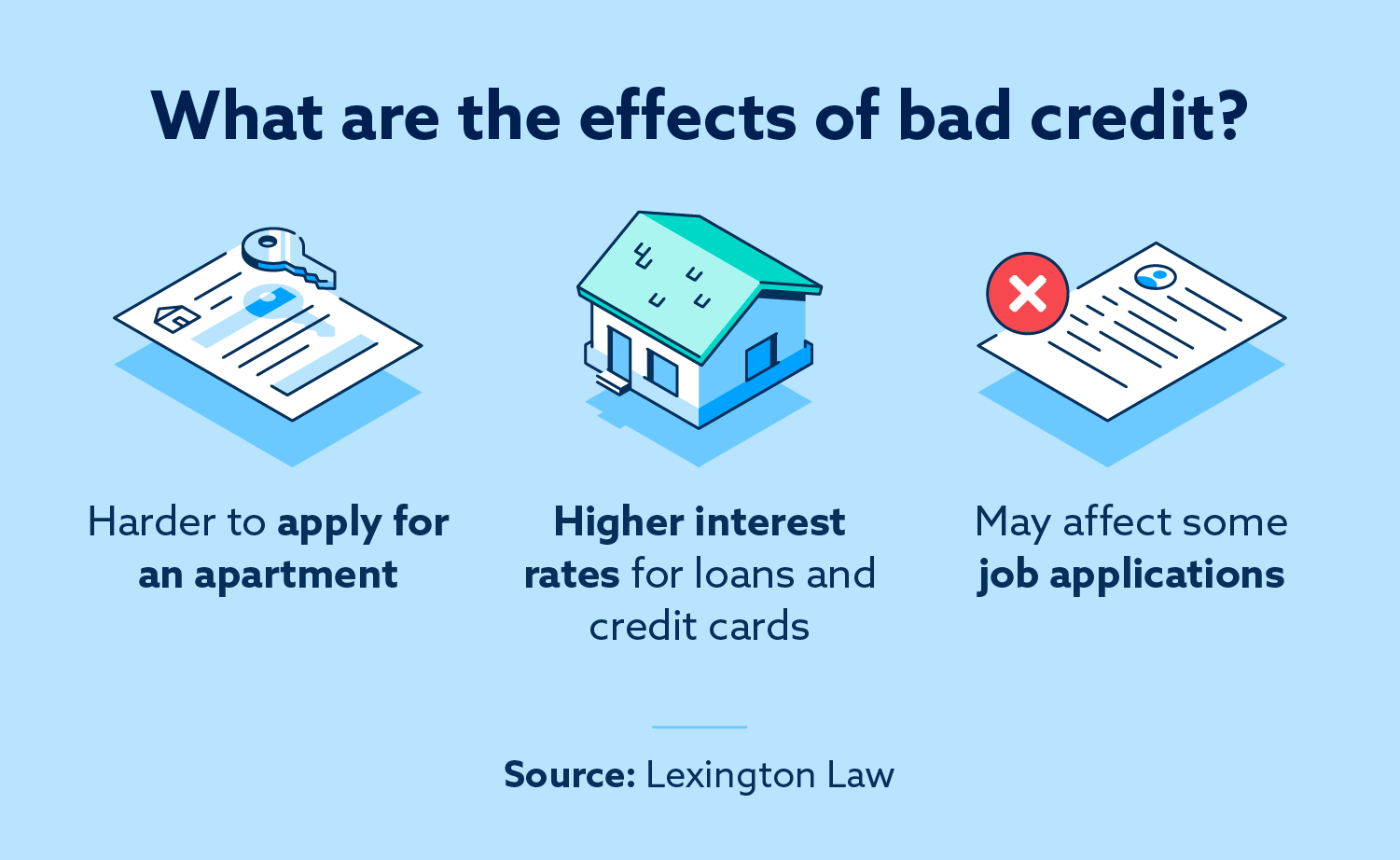

On a scale of 300 to 850, anything below 550 is considered a bad credit score. Get your free experian credit report! Having a bad credit history, a bad credit rating or simply bad credit usually means your credit reports (and the credit scores that derive from them) show negative credit.

A bad credit score with equifax is under 379. Contact both the credit reporting agency and the company that provided the. Ad 90% of top lenders use fico® scores.

Getting a mortgage with bad credit is possible, but it can be harder. They use your credit history to see whether you’d be. The law says you can get your free credit reports if.

That means one copy from each of the three companies that writes your reports. You need to follow few steps to find out errors in your credit report. Ad view your latest credit scores from all 3 bureaus in 60 seconds.

Getting a personal loan with fair or bad credit. Monitor your experian credit report & get alerts. How to find out if you have a bad credit rating powerpoint presentation

Follow these six steps to open a new credit card account and start working on improving your credit. You can get your credit report fixed if it contains inaccurate or incomplete information: However, you may still have options, and shopping around to find your best offers is still.

Cut debt by 50% or more. Ad apply with more confidence. You can get a free copy of your credit report every year.

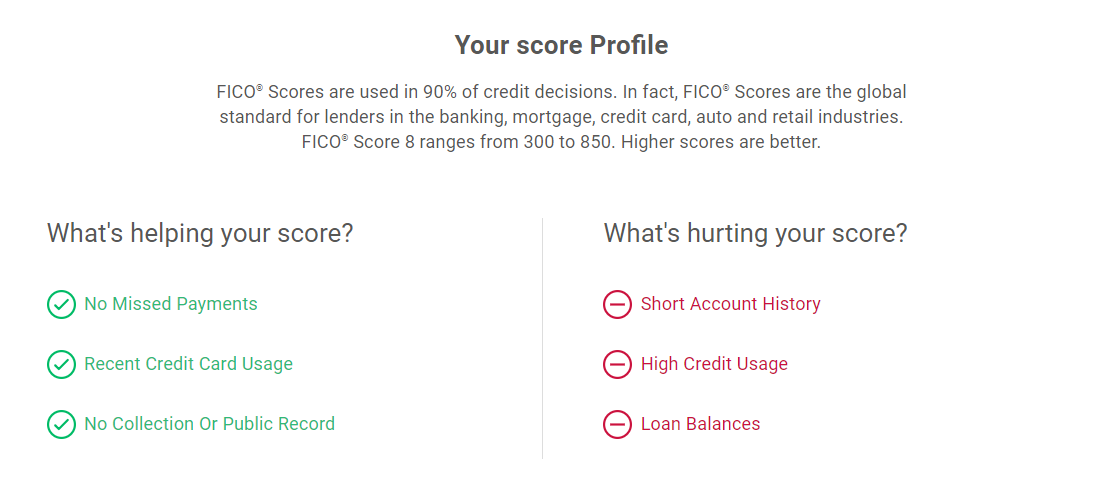

Lenders will look at the credit score of people who apply for a mortgage. It will demonstrate to lenders that you can borrow. See score factors that show what’s positively or negatively impacting your credit score.

Ad see what is on your credit report, including account history, inquiries and more. In the uk, having bad credit can impact how many lenders are willing to give you a credit card, mortgage or bank loan. 1.check your credit score either gaining or losing a few dozen points can make a huge.