Casual Info About How To Write A Hardship Letter For Loan Modification

Ad download or email bank forms & more fillable forms, register and subscribe now!

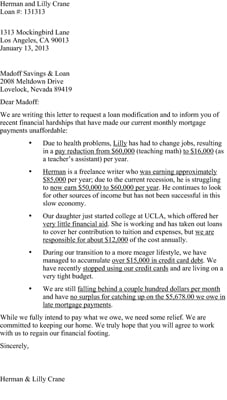

How to write a hardship letter for loan modification. Below is a sample hardship letter for home loan modification. People fall behind on their mortgage payments for a. I have been unable to pay my mortgage payments.

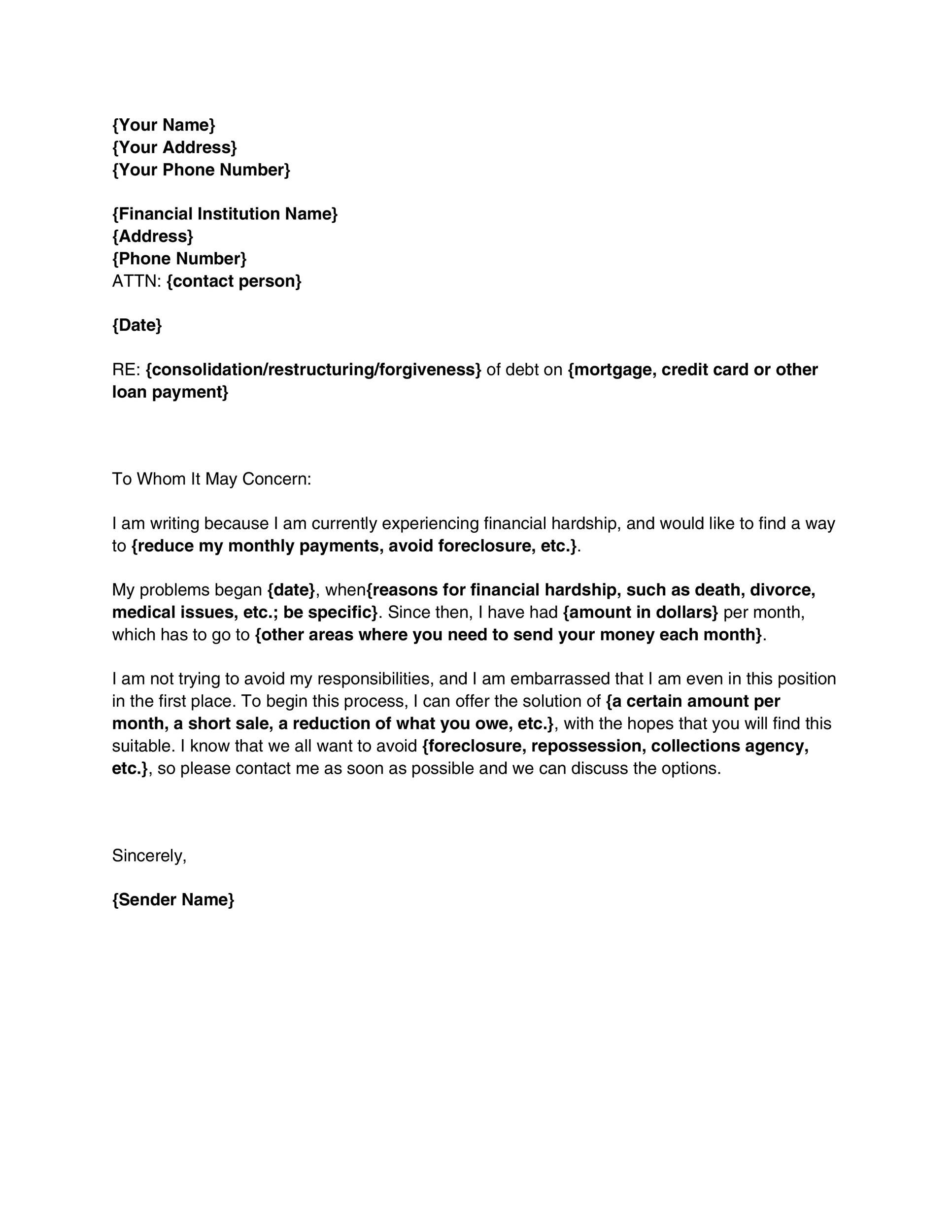

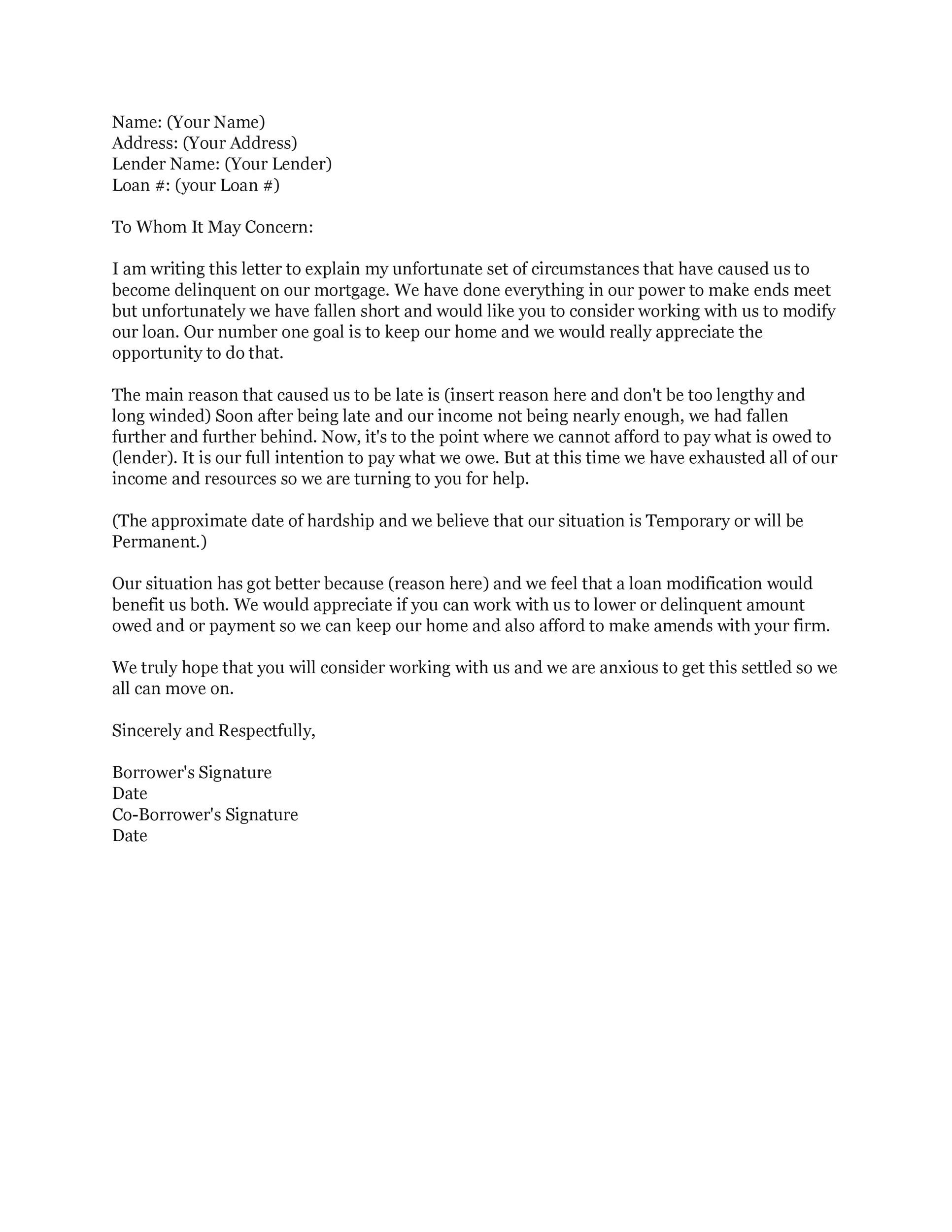

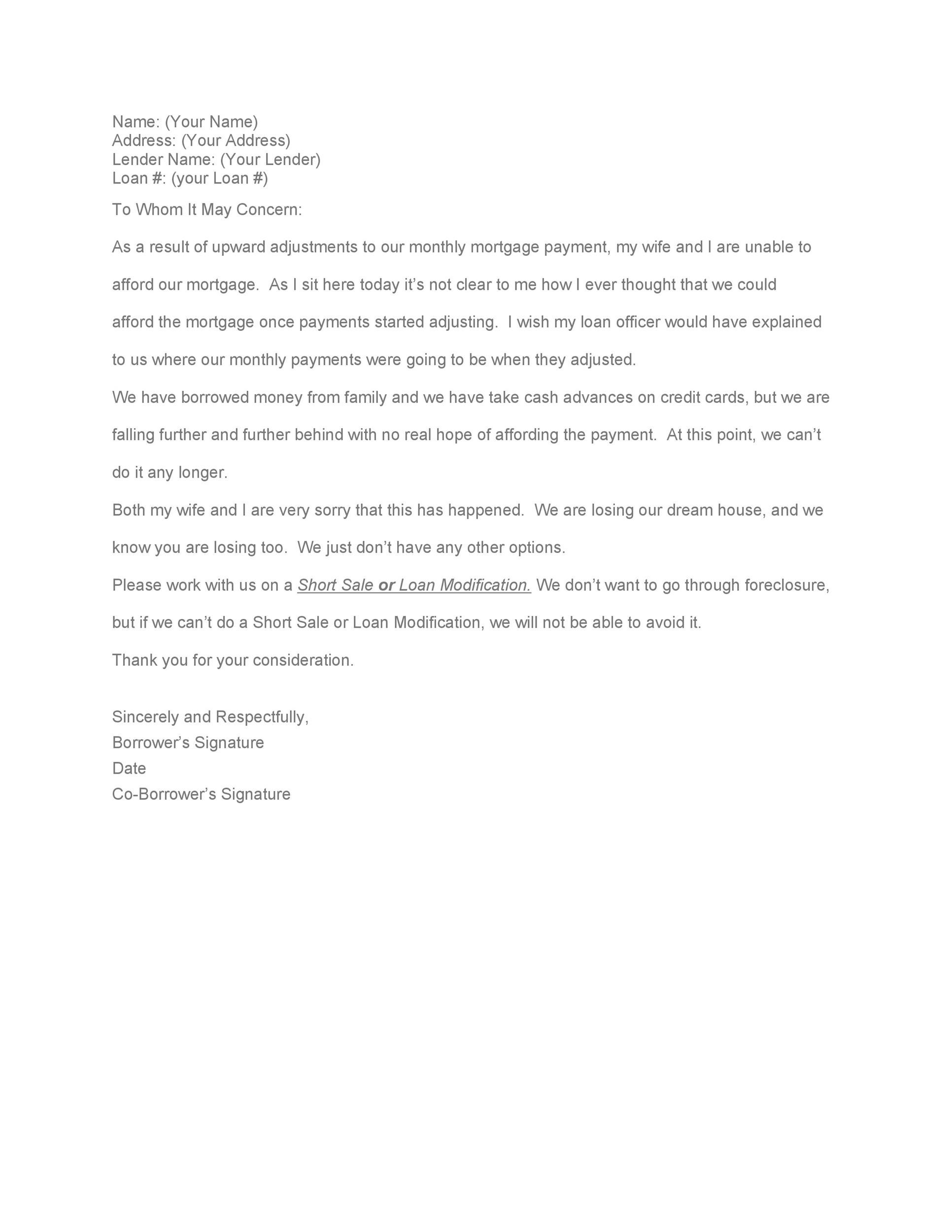

The first part of the letter is where you make a formal request in writing for a loan modification, where you will also include the hardship reason. We are writing this letter to explain the extreme financial hardship it will be for our family when our loan adjusts from a 7.75% interest rate to a 10.75% interest rate in august. Ad get started now on other refinance options you may qualify for with quicken loans®.

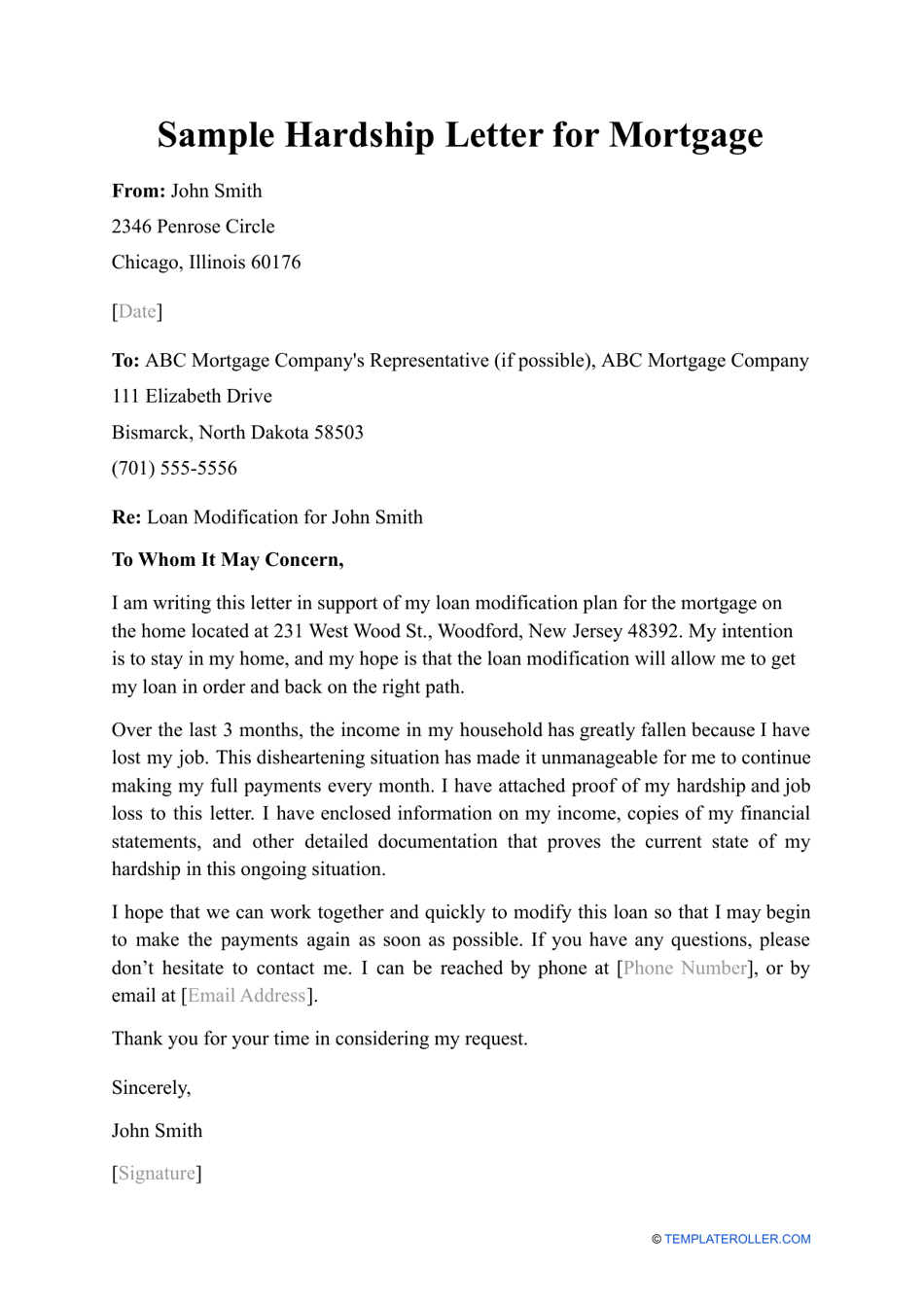

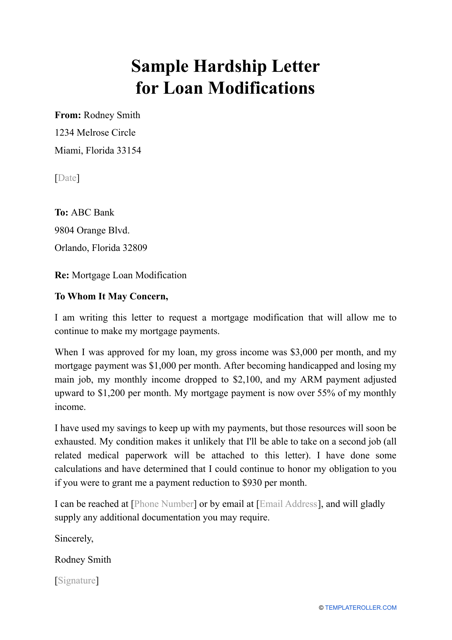

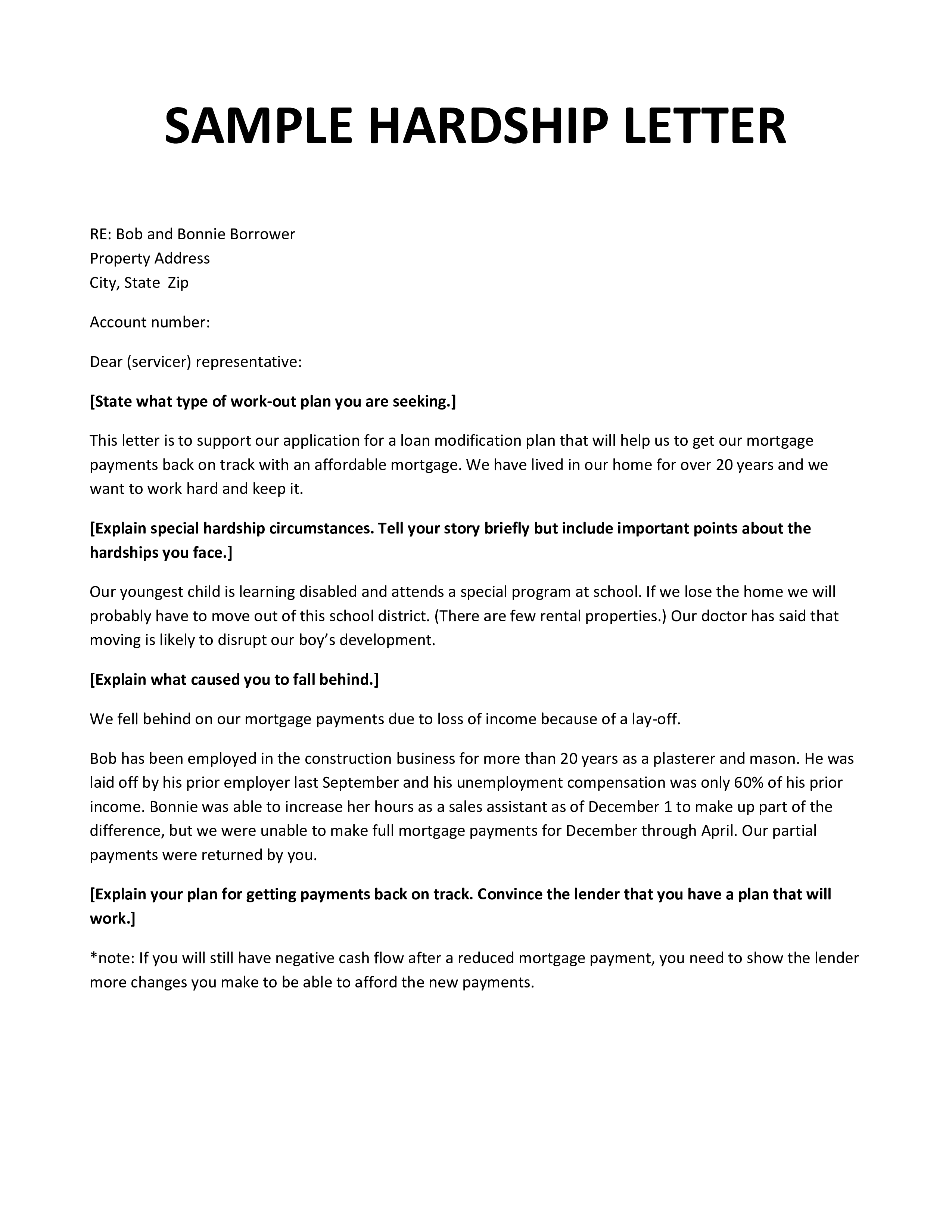

The following sample can be used to assist readers in preparing their own hardship letter: We have lived in our home for. This letter is to support our application for a loan modification plan that will help us to get our mortgage payments back on track with an affordable mortgage.

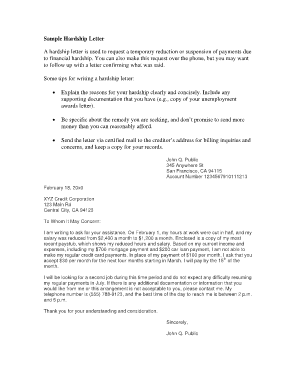

Typically, lenders spend less than five minutes reading a hardship letter so it’s in your. How to write a hardship letter for loan modification. In as much as you want to provide enough details as to why you’re falling behind your repayment.

Now that things are (improving, stabilized, et cetera), i (we) would appreciate your consideration to lower. Despite my (our) recent hardship, it is my (our) full intention to pay what i (we) owe. [your name] [your address] [date letter is sent] [your lending institution and address].

Don’t lie, exaggerate or share excessive personal. Why did you fall behind on your mortgage? It really only needs to be about a paragraph.

Go straight to the point: How to write a hardship letter keep the letter concise. Sample hardship letter for home loan.

My intention is to stay in my home, and my hope is that the loan modification will allow me to get my loan in order and back on the right path. How to write a hardship letter for loan modification caza’s distressed asset division’s rob chevez and michael benmira walk you through the process of creating the perfect hardship. Remember that every bank is.

Instructions for writing a successful hardship letter include your name, mortgage loan number, and property address at the top so your bank can locate your home loan easily. Work with america's #1 online lender to lower your payment or consolidate debt. Include income and asset documentation such as pay stubs, bank statements, and other relevant paperwork.