Impressive Info About How To Start A Cd Ladder

You give the bank a certain amount of money that is held for a specified term that you choose.

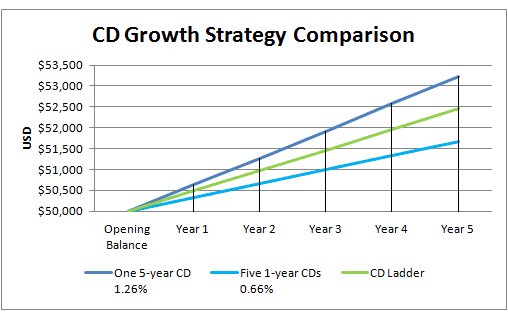

How to start a cd ladder. Begin by choosing if you want your ladder to be made up of cds or. How to build a cd ladder. However, the online bank citizens access offers a cd.

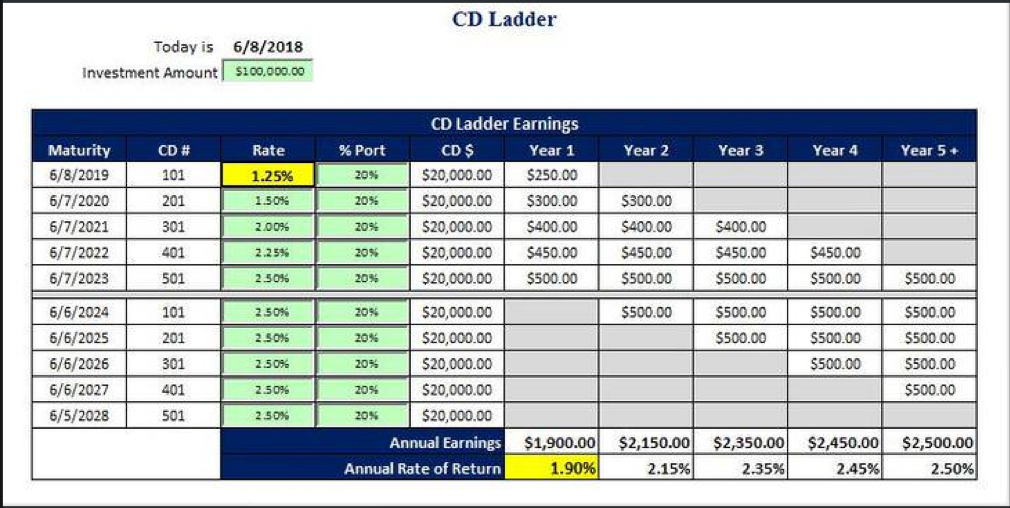

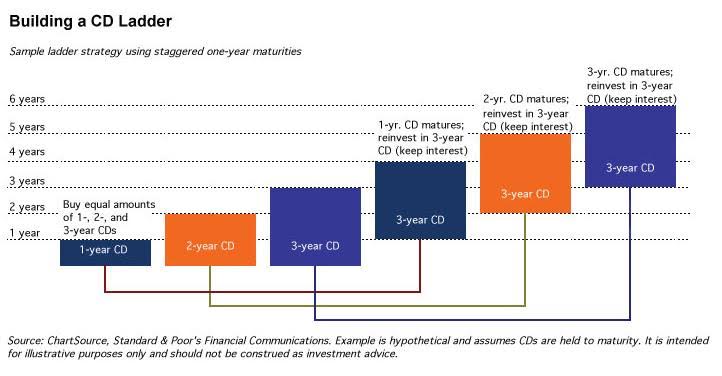

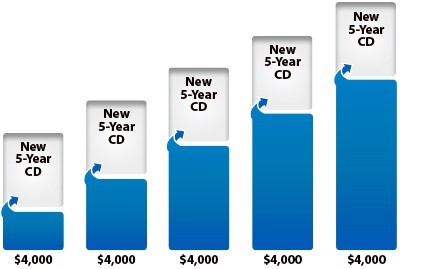

Let’s say you create a cd ladder with $20,000 you saved up. There are a few ways to build a cd ladder, depending on your financial goals and how long you plan to invest your money. You put $5,000 in a three.

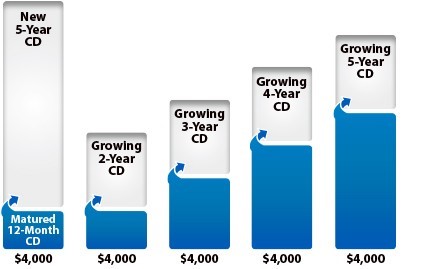

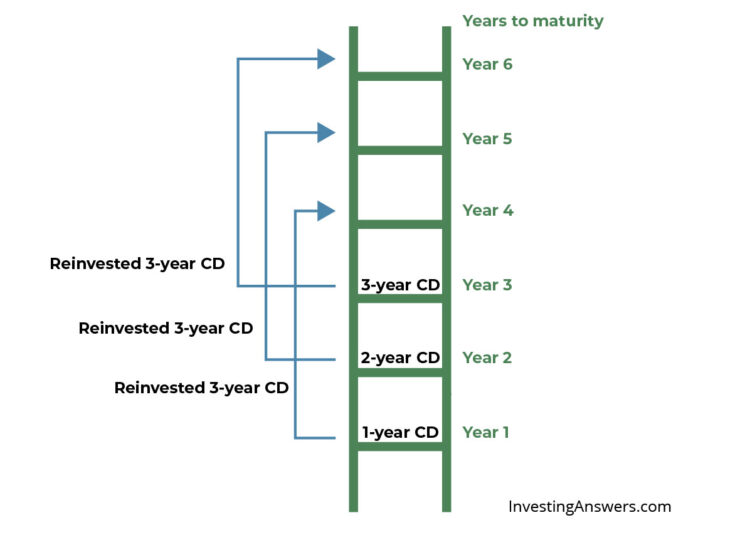

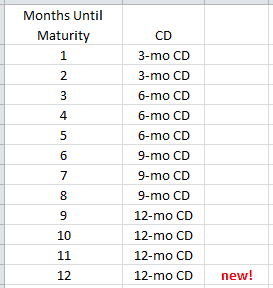

To start a cd ladder, you start with an initial sum of cash divided between multiple cds which mature at different intervals. Starting a cd ladder is easy. Divide the money evenly and open 3 cds with ascending terms 12 months apart.

Reinvest each cd when it matures Open the initial cds a cd ladder involves dividing your investment evenly into several cds of different term. Let's use $30,000 and build a sample 3 year ladder.

The rungs start from the shortest term (the bottom rung) to the longest term (the top. Building a cd ladder begins with making some decisions: Usually, creating a cd ladder involves you picking your bank and choosing the various terms to open all on your own.

The total amount you want to save the number of cds you want to open how much you want to keep in each cd. To build a cd ladder, you divide your total savings among several cds with different term lengths. On step 1, you'll choose to begin with a predefined or custom ladder, select your account, and initial investment.

Open separate cds rather than putting all the funds in one cd,. And staggering the maturity dates, can also help you boost your cash flow, says martin. A common cd ladder structure is based on annual.

For example, if you have $25,000 to invest, you might break it up like.